Cashing Out of Crypto. The classification of cryptocurrencies as property comes with some important caveats. To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Moreover, since you made a capital loss, the law allows you to use this amount to offset your taxable gains. Additionally, there may be state income taxes to be paid. Governments have observed surges of black-market trading using Bitcoin in the past. Do I pay taxes when I buy crypto with fiat currency?

Easily File Your Bitcoin and Crypto Taxes

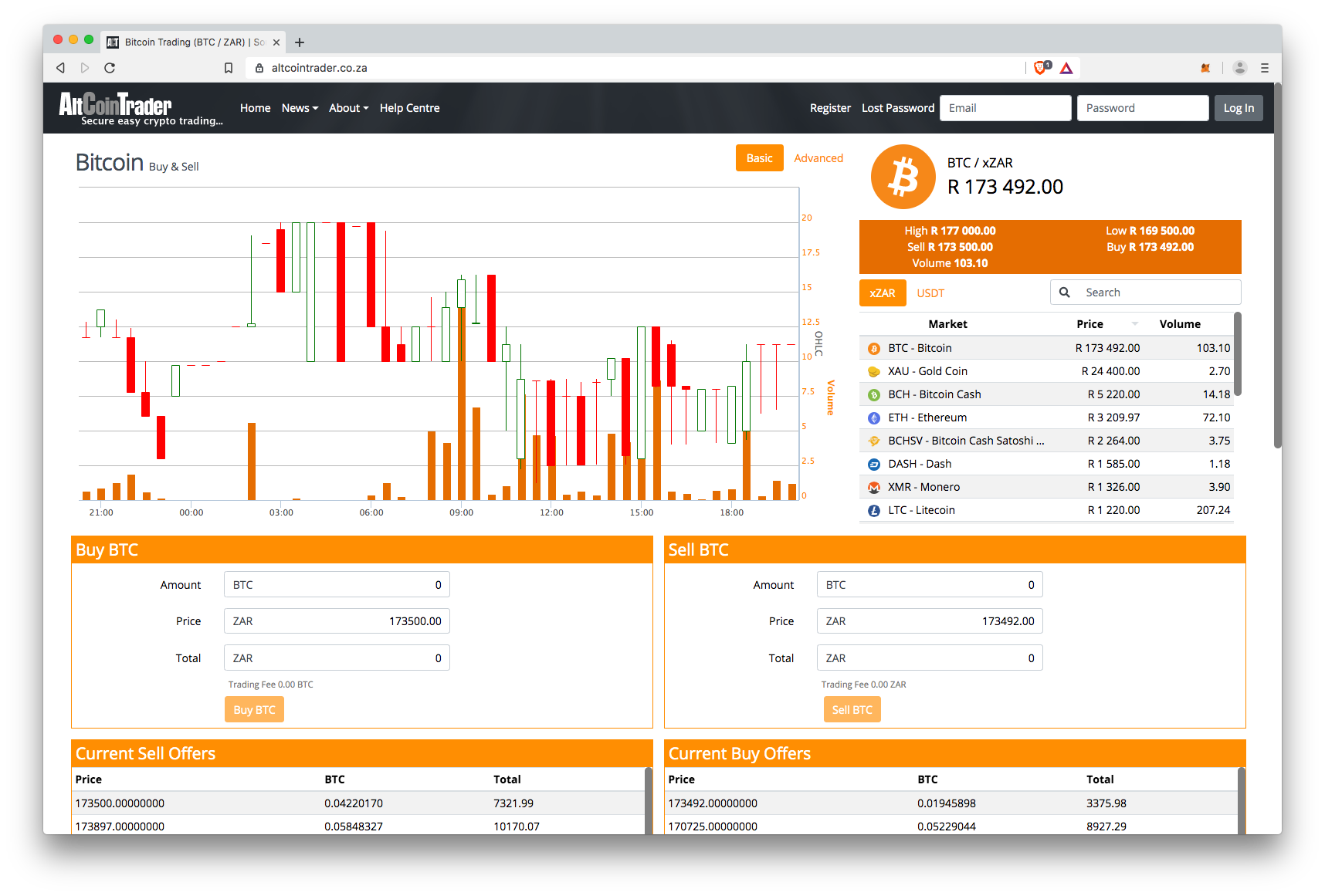

Last updated: 15 October We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias. But we may receive compensation when you click links on our site. Learn more about how we make money from our partners. As bitcoin prices fluctuate, it trading altcoins taxes like digital currencies are here to stay.

Get the Latest from CoinDesk

If you own or have traded cryptocurrencies, you may need to include these in your tax forms, even if you didn’t make any money. Tax is the most established crypto tax calculation service that can work out your capital gains and lossess and produce the data and forms you need to file your taxes. Simply upload or add the transaction from the exchanges and wallets you have used, along with any crypto you might already own, and we’ll calculate your capital gains. Donating cryptocurrencies can really make a global impact! Your donations help those in need, and can also provide tax benefits. We are excited to be partnered with BitGive, the first and leading Bitcoin and Blockchain non-profit organization, leveraging cutting-edge financial technologies to connect charitable donations to high-impact initiatives worldwide.

The Current Framework

This means that self-reporting is necessary. But, what about exchanges of crypto coin for a different type of crypto coin? The equation below shows how to arrive at your capital gain or loss. Exchanging Cryptocurrencies. Crypto coin traders who engaged trading altcoins taxes coin-for-coin trades in and earlier years should consider taking the position that their gains are deferrable under the Section like-kind exchange rules. Tax Cryptocurrency Tax Reporting. As taxee is a regulated activity which they are not authorised to offer in the UK, we advise you not to use this service.

Comments

Post a Comment