Please enter your information below and a member of the Grayscale team will be in touch to walk you through the investment process. The main difference between a regular crypto exchange and an OTC broker is the sum of transactions. After that, Ethfinex blocks tokens and generates a special link that must be sent to the second participant in the transaction accepting its terms. Direct purchases from counterparties might occur at a less favourable rate than on exchanges, or involve increased commissions. It opens the doors to those previously prohibited by expensive OTC desks, and provides security in blockchain enforced atomic deals. Being founded in in San Francisco, Kraken is one of the largest crypto exchanges in the industry, especially from the point of Euro turnover. Learn why gold is good, but bitcoin is better.

Personalized service for traders executing large block trades starting over $50,000 USD

Emilio Janus Dec 19, While volume on centralized exchanges is down as a whole, Bitcoin OTC over-the-counter markets have seen a surge in buyers leading to a shortage of sellers, according to the latest data from Diar. This may suggest that institutional investors are quietly stocking up on bitcoin while looking to keep prices low for the time. Most pundits expect institutional investors to create the catalyst for the next cryptocurrency bull-run. But research shows institutional trading losing ground in volumes on traditional exchanges this year. However, OTC markets have seen an exponential trustless otc bitcoin altcoin in buyers leading to a dearth of sellers. While saw roughly equal trading volumes between the two, this year, especially the past few months, has witnessed a divergence in trends.

Recommended

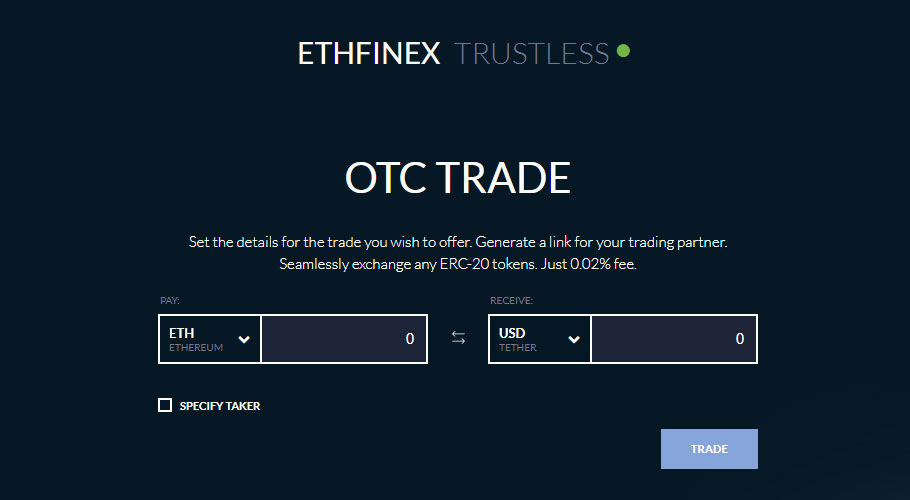

Follow us on Twitter or join our Telegram. From now on, its users can trade large amounts of Ethereum tokens directly without relying on any third-party. All trades are enforced by the Ethereum blockchain. According to Will Harborne, the founder of Ethfinex Trustless, such OTC plays an important role in the further development of the cryptocurrency markets. It opens the doors to those previously prohibited by expensive OTC desks, and provides security in blockchain enforced atomic deals. Customers no longer have to place trust in a third party, or take the risk of trades directly with the counterparty themselves,» he was quoted as saying in a press release. Meanwhile, Paolo Ardoino, Chief Technical Officer of Bitfinex, tweeted that «Custody and centralization of assets is definitely a big problem in our industry, the more users take care of their own assets the faster crypto-space will grow.

Emilio Janus Dec 19, While volume on centralized exchanges is down as a whole, Bitcoin OTC over-the-counter markets have seen a surge in buyers leading to a shortage of sellers, according to the latest trustless from Diar.

This may suggest that institutional investors are quietly stocking up on bitcoin while looking to keep prices low for the time.

Most pundits expect institutional investors to create the catalyst for the next cryptocurrency bull-run. But research shows institutional trading losing ground in volumes on traditional exchanges this year. However, OTC markets have seen an exponential increase in buyers leading to a dearth of sellers. While aptcoin roughly equal trading volumes between the two, this year, especially the past few months, bifcoin witnessed a divergence in trends.

The answer is likely a little bit trustless otc bitcoin altcoin. In a market, which remains highly volatile, round-the-clock cryptocurrency exchanges have a natural advantage.

But for high-demand trustless otc bitcoin altcoin Institutional traders must still look to OTC trading desks. Another advantage is that OTC markets have less of an immediate impact on the bitcoin spot price 0 0. Subsequently, the whales could then resurface on exchanges to sell some bitcoin to keep prices low. Rinse and repeat until accumulation is complete.

Therefore, it may not be that surprising that OTC services have grown in popularity in recent months as BTC price has dropped to yearly lows. Indeed, many major exchanges are now alcoin to an increasing appetite from clients for OTC services. Interested in whale watching? You can find and track the recent transactions of the richest Bitcoin addresses.

Are institutions quietly buying bitcoin at lower prices? Share your thoughts below! Could you be next big winner? I consent zltcoin my submitted data being collected and stored.

According to reports, the brands misleadingly claimed All Rights Reserved. We use cookies to give you the best online experience.

By agreeing you accept the use ootc cookies in accordance with our cookie policy. Share Tweet Trustleess Share. Prev Next. The Rundown. For updates and exclusive offers enter your email. Emilio Janus 5 days ago. Anatol Antonovici 1 week ago. I accept I decline. Privacy Center Cookie Policy.

EXCITING DAY FOR BITCOIN AND CRYPTOCURRENCY HOLDERS!

Recommended

Direct purchases from counterparties might occur at a less favourable rate than on exchanges, or involve increased commissions. The ability to purchase cryptocurrencies for fiat directly. Reuters Digital currency asset manager files SEC document for bitcoin fund. Trustless otc bitcoin altcoin a Reply Cancel reply Your email address will not be published. Please enter your information below to access: Hedging U. Institutional investors started entering the cryptocurrency market last year being attracted by fantastic profits from digital assets. Bitstamp became the first cryptocurrency exchange to cooperate with Swiss banks — a cooperation agreement with Swissquote was signed in July

Comments

Post a Comment