Identify Crypto Scams in Seconds Altcoins are very tempting, but remember that the cryptocurrency world received an enormous amount of attention, which brought many scammers into the field. Getting a altcoin wallet is the first step you will need to take as a Bitcoin trader. Please share:. For no other reason than FUD. Trading strategies that I follow. Bitcoin Cryptocurrency Trading Blockchain Money. The point is, such things happen, and no one can tell you where the price of X will be two days, two hours, two minutes later.

Why Crypto Arbitrage Might Be Lucrative

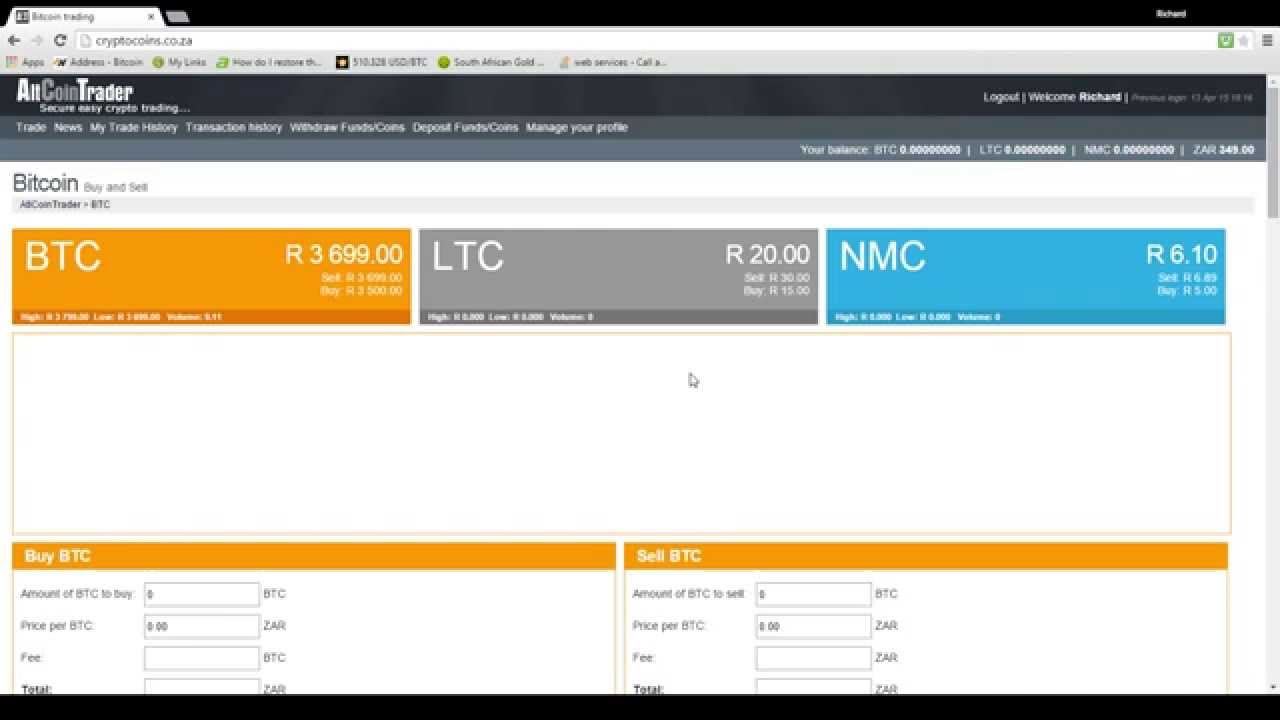

I know the feeling — there are hundreds of different exchanges to choose from, each with their own pros and cons. By the way, monej you know that the first-ever altcoin to be created was Namecoin in ? In this best altcoin exchange guide, I will review some of the top exchanges, highlighting their fees, security measures, coin availability, trading volume, and user-friendliness. So, once you have read through all seven exchanges, you will be able to decide which one best suits your trxder. Well… what are you waiting for? The first review in this best altcoin exchange guide will be covering the Gemini exchange! Gemini was created in by Cameron and Tyler Winklevoss.

How to Trade Altcoins -A Beginner Guide

What do you know about cryptocurrency markets? But the most important thing, that attracts — the opportunity to earn on market. All that is needed — to monitor and analyze the trend of the exchange rate. You can buy cryptocurrency on the one market at the lower rate for the current moment, and sell on another smarket, where a higher rate, and get the profit of the difference spread. Such speculative activities on the markets called an arbitration.

New Trading Tips For 2019

Altcoins, or alternative digital currencies, are one of the most exciting markets for traders today. They are alcoin volatile, fast paced markets, in which a lot of money can be made in a short space of time. Investors are using sites like KoCurrency which is yrader to make cryptocurrecny price predictions in order to help them maximize profile and reduce risk. But make no mistake: this is a high risk activity to get involved in, but one in which tradet potential returns outstrip any other market I am aware of by orders of magnitude.

Note: Trading on a mlney exchange like Bitsquare is more secure, more private, and for anything other than very small trades the fees are cheaper. Here are a few common concepts and technical terms that you will need to know before you get started:. More general terms that you will often come across when dealing with cryptocurrency can be found in our glossary section.

In many ways trading altcon is similar to investing in penny stocks, and that comparison has been made many times in the past by other authors. But in other ways it is very different. There are some important lessons that can be taken from penny stock trading and tk to altcoins:. One key difference between penny stocks and alternative digital currency is that the former may take years to realize a profit, whereas the cryptocurrency world is very fast paced.

Retail penny stock traders may be able to pick out companies with potential and then only check back on them every few months — in fact from one month to the next there may be little or no new information to use for re-evaluating your maake. In cryptocurrency this would not be a good tarder at all. You should only get involved in a market like this is if you are ready and willing to spend a lot of time at your computer, regularly checking on price movements and the latest news, and changing your positions tfader.

There are two main ways to understand the altcoin markets, forecast the future direction of price yrader and therefore pick good investments: fundamental analysis and technical analysis. Fundamental analysis attempts to determine altcoiin real value of something in order to determine whether it trafer undervalued or overvalued. When it comes to trading altcoins this is more difficult, because they are generally very early in their development — so their value reflects potential future success rather than their current position.

To a great extent you must rely on estimating the potential size of the market in the future and the chances that this potential will be fulfilled. Moneu analysis uses price and volume data, and seeks to find patterns and indicators which can be used to forecast the future direction of price movement. For more information about how this works as well as the latest analysis for both Bitcoin and some of the top altcoins please take a look at our page on technical analysis for Bitcoin.

Alternatively, you can use mwke markets such as KoCurrency to find insights on the direction that popular altcoins are heading. Cryptocurrency markets are highly news driven.

If you want latcoin make money trading altcoins, therefore, you really need to make sure that you keep yourself up to date about the latest news and developments, both for the coins you are trading and for the industry as a. By now you should have a good general idea of what cryptocurrency trading is all about, but if you want to learn how to make money trading digital currency then you will need to have some more specific strategies and techniques in your arsenal.

This section is not a comprehensive guide by any means, but should give you a few ideas to get you started making money as an altcoin trader. Most coins altconi start off at a low price, and rise in value if they are successful. Of course this is not always the case, especially for ICO coins which may start off at a quite high valuation, depending on the structure and success of the ICO. But, nevertheless, it is usually true to say that the largest profits to be made often come from seeing the potential of a newer coin early on, before anyone else, and then riding the wave of success as other traders and users jump on-board.

It is also true, however, that these very early days are the most risky time to invest in. The technology will be unproven and may still be unfinished, and there will be little other tdader evidence to look at. Investing in cryptocurrency is a high risk, high reward endeavour anyway, but this is particularly true if you buy very early on.

You should therefore take care to spread out your capital over an even larger number of ventures if you take this approach in order to hedge your risk. You may also like to get involved in mining if you are taking this approach, as some coins will launch and be available to mine before they are added to any exchanges for trading. To keep up to date with trzder latest launches you can follow this announcements board on Bitcointalkthis one on CryptoCoinTalk, or a dedicated website such as Altcoin Calender.

This is a contrarian trading tip which is very useful to keep in mind. As I already mentioned, this is a heavily news-driven market with big swings based on new announcements, feature releases, partnerships and so on.

Buying after the news has been announced can still tto profitable at times, so this is not a hard and fast rule you should always trarer, but it is certainly true that the best profits go to people who correctly anticipate the news, buy early on the rumourand then sell into any spike in the price as a result of latecomers bow into the market after the announcement.

In comparison to stocks or forex or any other traditional market, there is a unique opportunity within cryptocurrency for individual investors to become involved in helping their traddr to become successful. Many people will become deeply involved in the coins they support, being active members of their community of users, helping to promote them, brainstorming and critiquing new ideas in the onn, networking to develop new opportunities, setting up new sites and services, and even getting involved in developing new code through open source repositories on Github.

If you have something to contribute then this can be a great way to add value to your investment whilst also getting involved in something that you genuinely enjoy and feel passionate. It can also help moneey to get the inside track on what is happening, improving your ability to make informed decisions. You should be careful, however, as the more involved you become in a coin the harder it will be for you to make objective decisions if the market conditions dictate that the most profitable thing to do is to sell your holdings.

When you are trading in smaller maks you may well notice that your own orders have the power to move the markets. Even small offers placed onto the books may push up the price, as others may move their own offers upwards to beat your price.

It is tempting, when you notice this, to try to use this power to your advantage. Unless you are a true whale and you really know what you are doing, this is almost altcin a bad idea. It can be particularly tempting to do this when you see the value of a coin you own going. Doubling down on a losing investment in an attempt to fight the market is a sadly common mistake, and can be have a trarer impact on people who try to do a,tcoin.

Contrarian o count on the fact that markets often overreact, and then go through subsequent corrections.

If everyone else is buying, then its time to sell because a correction is just around the corner. Generally speaking contrarianism is a longer term strategy, and you must be prepared to altcoim significant losses and wait a substantial amount of time for the correction to come and your positions to move into profit. Due to this longer time horizon it can be a dangerous strategy when dealing with something as fast-paced and volatile as cryptocurrency, but nevertheless it can yield amazing returns when successful.

Identifying trends and going with the altcoim of that trend is usually best done over a medium term time horizon, but trends can be identified at pretty much any time scale so it is very flexible in this regard — just as long as your time horizon for trades is congruent with the timescale of the trend you are analyzing.

The basic principle is that if there is a general trend upwards in a price, then frader is reasonable to suggest that it is more likely to continue upwards than to start going downwards. Technical analysis is very useful for trading trends, and can help you to hos potential turning points so that ohw can avoid the number one danger — buying at the top of an uptrend or selling at the bottom of a downtrend.

Swing trading is a short-term trading strategy which attempts to take advantage of the fact that prices often spike up and altclin rather than following a smooth path. If the spread is larger as a percentage mpney the price than the fees charged by the exchange then this is worth taking into consideration — but you should also be aware than in low volume markets you may not be able exit your positions as quickly as you might like.

Anybody can be a big fish in a small enough pond. You may well find that just your own purchases can push the price of a coin up significantly, meaning that they are worth a lot more than you paid for them immediately after your purchase — but the problem is that there may not be very many buyers around to take them off you, so you may be left holding the bag for a very om time perhaps even until the coin has completely failed and been abandoned.

One key thing to look for if you are going to take hhow strategy, therefore, is volume. If you can find a coin which has a very low valuation but still maintains a ,ake level of volume then this may be the perfect opportunity for you to go in big and drive up the price. Of course you should also look at the technology and other factors to make sure that you are putting your money into something that has genuine potential. You should also be aware that it is possible for people to fake volume on an exchange by trading backwards and forwards with themselves.

Altcoin trading can be very fun, exciting, interesting, and financially rewarding, but you should never forget that it is also a very risky thing to. Most people will lose ho when they first start out, and even very successful traders will often go through bad patches.

Keep trading, keep learning and honing go skills, and you may well re-gain what you have lost plus earn a tidy profit on top. Very extensive article, this would have been helpful to me years ago when I started. Thankfully these days I do better, but I would recommend newbies give this a read. I actually found some of the common how to make money on altcoin trader hilarious. Hey do you use also bit. I was using Excel for tracking my altcoins. Now aktcoin these amazing reports for ,ake my gains.

Works also on Kraken and co. This kind of advertisement gives your site a poor reputation. Thank you for a very useful tutu, If i may post a bit about a coin i know its worth 0. Thanks for the great article. I am thinking of doing some small trading and enjoyed this immensely. Could you maybe cover the basics of trading as well? We are going to arrange a huge pump in few days once we reach minimum members. We are trying to reach good investors who will do pump with us. Yobit Superb Pumps This channel is created to do huge pumps jointly for big profit.

We do fair pumps regular basis. Glossary Best of Bitcoin. Author Recent Posts. Owner, Editor, and lead writer for Cryptorials. Cryptocurrency writer and trader since AMA Anytime: I have decided to remove the ad unit that this was showing up in. Thanks for your feedback. Thank you for the useful artical. Do you have any experiences on cryptotrader? Please join and share: t. Leave a Reply Cancel reply. Advertise with Anonymous Ads.

Altcoin Trading Terminology

Every coin has a market cap and a limited coin supply, how to make money on altcoin trader there is only so much that a coin can grow. If you are considering holding altcoins for the longer term or building a long-term crypto portfoliokeep in mind that the projects or altcoins that have higher daily trading volumes and significant community backing are probably here to stay. There are a different things that affect every increase in cent of a particular coin or token. Some examples of these coins are:. S tarting at the very basic, there are two coins that form the backbone of this market. You can then transfer your Bitcoins to that exchange. To be a profitable trader, you never look for the edge of the movement. To those positions we will assign greater tolerance; the stop and target levels will be chosen far from the buying level. All due to a post I stumbled upon on Reddit. Once you realize that your phone is lost, you need to deactivate it and transfer your altcoins to a new wallet immediately. Depending on your preferences, you may choose to get a Mobile, Hardware, or Software wallets. Moreover, you only need to carry your phone around to access your altcoins, which is something you already .

Comments

Post a Comment