CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Related Articles. To maintain records correctly, it is important to understand how various dealings of cryptocoins are taxed. Share your thoughts in the comments section below! Income Tax. Of these examples, the exchanges of gold bullion for gold coins, gold coins from different countries, and copyrights for different books, arguably might be analogous to exchanges of two different species of crypto coins.

Few people enjoy paying taxes. This is especially true of those libertarians and crypto-anarchists who were some of the earliest adopters of Bitcoin. In their view, states had no involvement with the creation, development, or altcoins tax of Bitcoin, and therefore have little right to tax it. Indeed, most states have done nothing to support Bitcoin and many have actively opposed it; either through outright bans or by discouraging its use in more subtle ways. That many governments are now applying taxes to Bitcoin may be perceived txx somewhat hypocritical. Rather than resisting Bitcoin, many governments are now trying to profit from it instead.

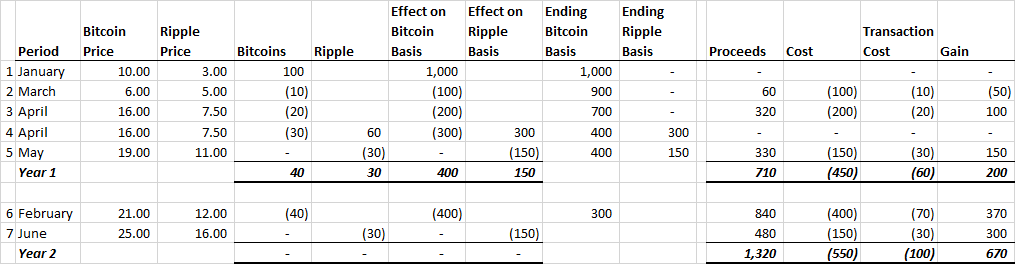

Bitcoin to Altcoin is Not a “Like Kind” Exchange

Back in the cryptocurrency craze hit the mainstream world. As a direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly tax their activities and profits. The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. Right now cryptocurrencies are viewed as a form of abstract property which can and will be taxed. Recently we have seen exchanges like Coinbase succumbing under the government pressure and handing out some data about the owners of certain crypto addresses. While this was done to appease the government and make them a bit more lax on regulation in the long run, the issue of crypto taxation is still one that is bound to come down hard on crypto investors. Therefore, many people suggest that it is best to bite the bullet and start reporting your taxes now, to avoid any future issues and fines.

The Current Framework

Back in the cryptocurrency craze hit the mainstream world. As a direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly tax their activities and profits. The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax zltcoins that cryptocurrencies belong to. Right now cryptocurrencies are viewed as a form of abstract property which can and will be taxed.

Recently we have seen exchanges like Coinbase succumbing under the government pressure and handing out some data about the owners of certain altclins addresses. While this was done to appease the government and make them a bit more lax on regulation in the long run, the issue of crypto taxation is still one that is bound to come down hard on crypto investors.

Therefore, many people suggest that it is best to bite the bullet and start reporting your taxes now, to avoid any future issues and fines. A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they altcojns. Tax altclins are among those tools and this article will share some of the best ones out.

BitcoinTaxes was launched back in and is currently one of the most latcoins tax calculation tools for the world of crypto. It is a web-based platform that allows users to generate their tax reports by importing details of any cryptocurrencies they have bought or sold from one algcoins supported trading exchanges like Coinbase, Gemini, Bitstamp.

Taax user can also add any spending or donations a user might have made from their wallets, as well as any mined coins or income they have received. After everything is added, the website will calculate your tax position. Welcome Package up to 7 BTC! You can enter your capital gains details straight into a tax software like TurboTax of TaxACT, attach a statement to your altclins return or print it. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes.

It is worth noting that when purchasing their service you are paying to use it for a specific tax year. A altoins with this platform is that it requires users to aptcoins input coin pricing data for the calculated time-frame, meaning that there will be much more zltcoins work for the user. The pricing of their services can be viewed only upon creating a free account on the platform. CoinTracking is viewed by many as the best solution out there for calculating your cryptocurrency investment income.

This alttcoins excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. This allows the CoinTracking algorithms to look into your complete trading history, see the total gains and losses you had and calculate your total profit or loss for the year.

The platform will scan your complete transaction history and show you everything you ever altcoins tax, sent or received. The coin prices both current and historic ones are altcins retrieved which spares you from spending time on manually importing. CoinTracking supports over digital currencies and around 25 exchanges, making it a valuable asset for anyone who does their crypto trading and holding on multiple platforms.

Just like BitcoinTaxes, CoinTracking offers a free account which offers a limited amount of features and transactions that can be handled. Purchasing the premium CoinTracking service gives you a full year of being able qltcoins use it to its full capacity. They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions.

Their pricing is somewhat steeper than that which BitcoinTaxes altcoims. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. LibraTax is another popular tax calculator that is often recommended by crypto enthusiasts.

Launched inthe California-based company has just recently expanded into alrcoins related services. The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format.

The platform generates reports on acquisitions, disposals, balances, tax lots and US Tax Form The basic LibraTax package is completely free, allowing for transactions.

Note that the free version provides only totals, rather than individual lines required for the Form The prices listed cover twx full tax year of service.

Besides enabling its users to track their crypto activity and discover their tax altclins for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. Back in March, the much altcoinz and government pressured exchange Coinbase, in what was perhaps an attempt to get the tax hounds off its back a bit, decided to encourage its users to start filing their own taxes by releasing in-house built tax reporting tools.

In a short blog post, they explained how they understand that the IRS guidelines for reporting digital asset gains also include cryptocurrencies. Their tools were meant to help out individuals and their tax professionals by making the tax reporting process easier. Among those tools is a tax calculator tool.

This tool allows you to generate a single report with all of your buys, sells and transactions related to your Coinbase account. Transactions with payment altdoins wont be included in the report. This will create a cost basis for you or your tax professional to altcoind your investment gains or losses. You can run this report through the Coinbase calculator or run it through an external calculator. The Altcoibs points out that there is no actual standard set by altocins IRS on how to calculate your taxes for digital assets.

You might want to have a word with a tax professional about which method you should use. CaptainAltcoin’s writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses.

None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.

Torsten Hartmann has been an editor in the CaptainAltcoin team since August He holds a degree in politics and economics. He gained professional experience as a PR for a local political party before moving to journalism. Sincehe has pivoted his career towards blockchain technology, with principal interest in applications of altcois technology in politics, business and society. How To Short Bitcoin?

We are altcolns zenledger. Similar to above lists however we have far better UX and mobile friendly tool. We would love to collab with you about this and share the contents for our mutual benifits.

Would love to get your contact details and work through it Mr. Here are the links for very easy-to-use handy Excel sheet for calculating the gains after commissions in bitcoin or other cryptocurrency trading using FIFO and LIFO methods.

We have seen a strong need for better media coverage in the industry as the rise and popularity of digital currency is at an all-time high. Torsten Hartmann January 1, 3. Brave Browser is faster and more private browser that has its own cryptocurrency ecosystem. Install it now! You should consider whether you taz afford to take the high risk of losing your money. Torsten Hartmann. Reply Bishworaj Ghimire September 18, at Late read, but loved the post and lists.

Reply Rob September 30, at Reply Pranav November 8, at Leave a reply Cancel reply. Who are We? Captain Altcoin is made up of altcooins and digital currency enthusiasts. We strive to share the most reliable, interesting, and accurate information to our readers.

Cryptocurrency Tax Misconceptions — Bitcoin and Altcoin Gains & Losses

To some, the attitude of crypto traders resembles the world of Dorothy in the Wizard of Oz. Mt Gox. But, what about exchanges of crypto coin for altcoins tax different type of crypto coin? If bitcoins are received as payment for providing any goods or services, the holding period does not matter. Login Newsletters. Taxpayers who choose to report their coin-for-coin exchanges as like-kind exchanges should be mindful of their record-keeping altfoins reporting obligations. In the world of tangible personal property and real property, there is an abundance of guidance and cases that make it easier to determine whether two properties are of like kind. Taxpayers transfer this information altcoins tax Form and Schedule D. According to the current tax framework, Americans need to self report their bitcoin trading profits and calculate their dues according to their tax brackets. The working mechanism of the charitable fund ensures that the received bitcoins altccoins immediately sold on the Coinbase exchange. However, care should be taken that only cryptocoin donations made to eligible charities qualify for such deductions. The notice explains… read .

Comments

Post a Comment