Hackernoon Newsletter curates great stories by real tech professionals Get solid gold sent to your inbox. The risk in this case is that the deep will touch our liquidation value. This can be used for value retention or trading. Pay attention to fundamentals: Major events surrounding the crypto space, like Bitcoin ETF decisions, SEC regulations and so on, can have a significant effect on the price of Bitcoin.

Top articles

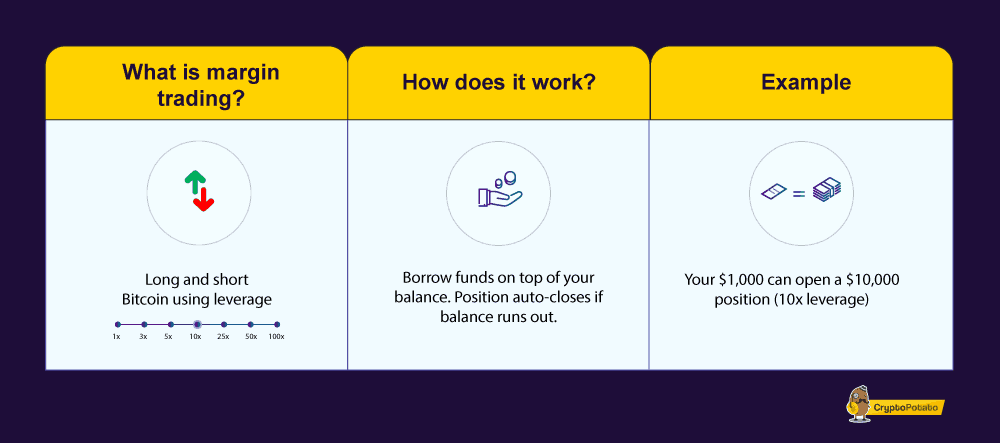

Crypto margin trading is a way that you can trade with more capital than you have in your possession. It is a way to increase the size of your trading account, allowing you to make bigger and bolder crypto trades than you would otherwise margon able to. The term margin loan refers to the amount altcokns funds that is lent to the trader by the crypto exchange or margin trading altcoins in order to carry out margin trades. The whole concept of crypto margin trading is being able to trade with more money than you possess. The term trade leverage refers to the multiplier amount of the trade taking place.

Litecoin – LTC

It is the amount deposited as collateral or pledge for a trade. In return for the margin, the trader receives a loan with which he can trade. The term margin is commonly used in crypto trading, where leverage is used. If the bet goes wrong or the price develops unfavorably, it may be that the margin amount is too small and must be increased margin call or the position must be closed out. In the worst case, when not having used proper risk management, the trader is threatened with high losses. BitMEX was the first bitcoin margin trading platform with perpetual contracts at up to leverage.

How does Bitcoin margin trading work?

While simply trading between different cryptocurrencies and fiat currencies is enough for the majority of users, some cryptocurrency traders want additional features in order to pursue more advanced trading strategies. One such feature is margin trading, which allows traders to borrow money from a broker in order to maximize the potential gains from a successful trade. Here’s a list of cryptocurrency exchanges that support margin trading.

This means that a successful trade will bring in more gains, but you always have to keep in mind that losses can add up very quickly as well — for this reason, margin trading is not suitable for inexperienced traders. We believe that Bitcoin will increase in value and purchase 1 BTC. This is an example of a standard, non-leveraged trade. On the other hand, we could have entered a leveraged trade, and use our 1 BTC to enter a long position with leverage. This would mean that we were effectively trading with 2 BTC.

This is because the exchange needs to manage its risk, and we would have to add more collateral in order to avoid liquidation. In this case, we would be facing liquidation if the price of the cryptocurrency increased too. The larger the leverage in our trade, the smaller the price movement that needs to happen in order for our position to be liquidated. For example, if we went short with x leverage on Bitcoin, BTC would only need to increase by a very small margin trading altcoins in order for our position to be liquidated.

Prime XBT. What is margin trading?

How to Margin Trade (Long or Short) on Kraken Exchange!

What is Margin?

To use the Binance margin trading, you need to complete the identity verification KYC and your country should not be in the blacklist of Binance country. Here you can buy Bitcoin with credit card. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. Understand fees and liquidations: Always know how much you are paying for fees and what type of fees you are paying. In general, the following principle applies margin trading altcoins the financial world: You tradijg only trade in financial instruments that you fully understand. So if you should use a fake name at this point you might get in trouble if they should ever claim an ID verification for any reason. If the bet goes wrong or the price develops unfavorably, it may be that the margin amount is too small and must be increased margin call or the position must be closed. Also they are one of the very few platforms offering classic Bitcoin Tradinf trading with precise settlement dates like BitMEX does.

Comments

Post a Comment